income tax rates 2022 uk

Find out which rate you pay and how you can pay it. 202122 Tax Band Thresholds.

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

The share of pre-tax income flowing to the top of the UK income distribution is significantly higher than it was in the early 1980s.

. Basic rate band values for England Northern Ireland and Wales have been corrected from 37000 to 37700. Dividend Tax rate 202122 Dividend Tax rate 202223 Basic. How much income you can earn before you start to pay income tax.

13 April 2022. Find out more in our guide to income taxes in Scotland. The rates and bands in the table below are based on the UK Personal Allowance in 2022 to 2023 which is 12570 as confirmed by the UK Government at their 2021 Autumn Budget.

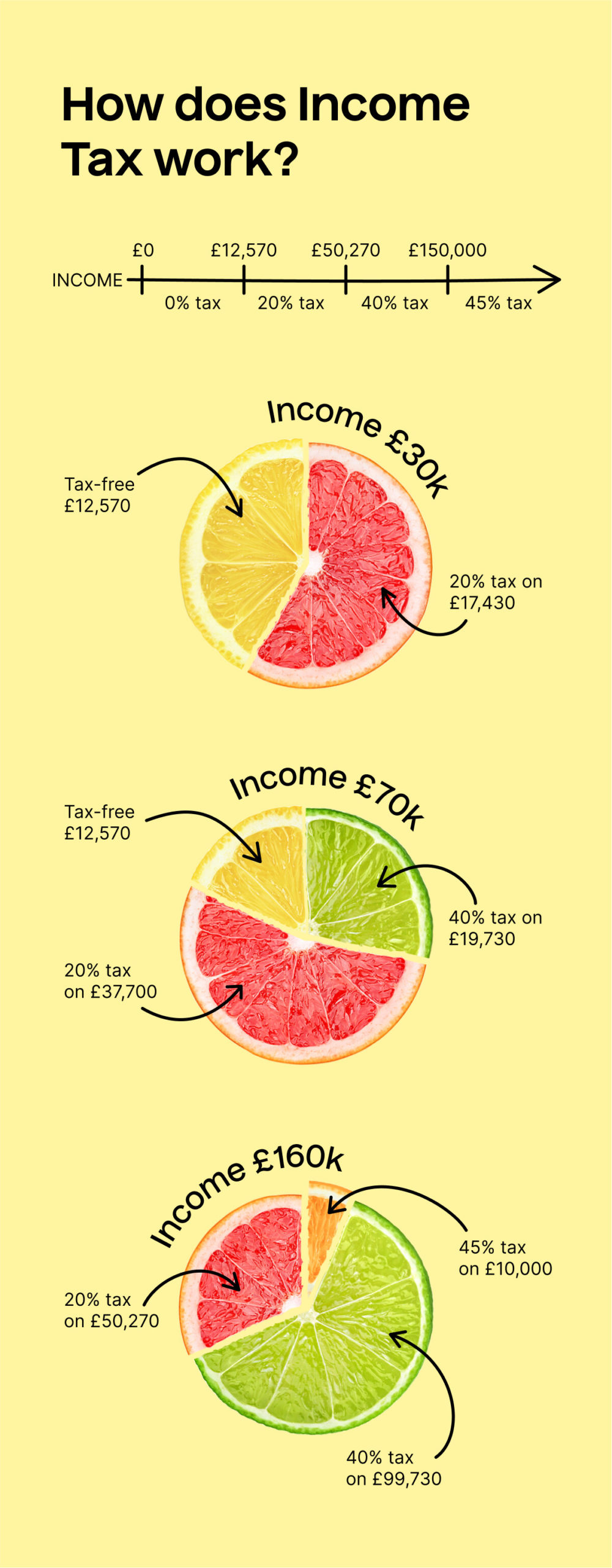

242 per week 1048. The amount of gross income you can earn before you are liable to paying income tax. Income up to 12570 - 0 income tax.

Personal Savings Allowance Basic Rate Taxpayers 1000. 202223 Tax Band Thresholds. Income tax on earned income is charged at three rates.

20 tax on the proportion of income which falls into this tax bracket. Band Taxable Income Tax Rate. In England Wales and Northern Ireland the basic rate is paid on taxable income over the Personal Allowance to 37700.

Class 1A employers On employee taxable benefits. The tax rates and bands table has been updated. It will set the Personal Allowance at 12570 and the basic rate limit at 37700 for tax years.

Income Tax for Scotland. 10 hours agoTop income inequality and tax policy. Basic rate 20 per cent on income between.

A statutory reduction in this amount to GBP 200000 as from 1 January 2022 is enacted in UK law but an extension of the GBP 1 million limit to 31 March 2023 is expected to be enacted later in 2022. Income Tax Rates and Bands in Scotland. This column explains the nature of top incomes in the UK and how they are taxed.

242 per week 1048. This is your personal tax-free allowance. No tax on this income.

Isaac Delestre Marcel Prokopczuk Helen Miller Kate Smith 03 August 2022. UK Income Tax rates and bands 202223. Higher rate Anything you earn from 50571 to 150000 is taxed at 40.

Chargeable gains 019. The employee standard personal allowance remains at 12570 per year or 1048 monthly. The rates are as follows.

Everyone who earns income in the UK has a tax-free personal allowance of 12570 per year. Income above 150000 per annum is charged at 45. Additional rate Anything you earn over 150000 is taxed at 45.

Sunak said each penny cut from the rate of income tax would cost around 6 billion pounds 73 billion a year a figure that he said would still allow Britains debt-to. The basic 20 and higher 40 bands also remain unchanged 37700 and 15000 per year. Income 202223 GBP Income 202122 GBP Starting rate for savings.

Branches 19 Corporate income tax rate. Income Tax for England Wales Northern Ireland. 0 0 to 5000.

Income taxes in Scotland are different. 4 rows PAYE tax rates and thresholds 2022 to 2023. Tax rate band.

After that the basic rate of 20 Income Tax is levied on earnings between 12571 to 50270 the higher rate of 40 is for earnings between 50271 to 150000 and the additional rate of 45 is for any earnings over 150000. These income tax bands apply to England Wales and Northern Ireland for the 2022-23 2021-22 and 2020-21 tax years. PAYE tax rates and thresholds 2021 to 2022.

Corporate income tax rate 19 Corporate income tax rate. Basic rate Anything you earn from 12571 to 50270 is taxed at 20. Personal Savings Allowance Higher Rate Taxpayers 500.

The employer rate is 0 for employees under 21 and apprentices under 25 on earnings up to 967 per week this is 242 starting 6 June 2022. For 202223 these three rates are 20 40 and 45 respectively. 4 rows Income Tax band.

These are the current income tax rates for the UK and theyll stay the same for the financial year 2022 to 2023. The current income tax rates in the UK are 20 basic rate 40 higher rate and 45 additional rate. What are the tax rates for the 202223 tax year.

The basic rate the higher rate and the additional rate. Tax is charged on taxable income at the basic. UK tax brackets 2022 the self-employed should know These are the income tax rates and thresholds the self-employed should be aware of in 202223 these are the same as 202122.

2 days agoRishi Sunak trailing in the race to become the next UK prime minister committed to reducing personal taxes by 20 within seven years in a. Basic rate income tax. Entitlement to contribution-based benefits for employees retained for earnings between 123 and 190 per week.

Income between 12571 and 50270 - 20 income tax.

Tax Principles Relx Information Based Analytics And Decision Tools

2022 Corporate Tax Rates In Europe Tax Foundation

6th April 2021 Tax Changes Confirmed Payadvice Uk

80 000 After Tax 2022 Income Tax Uk

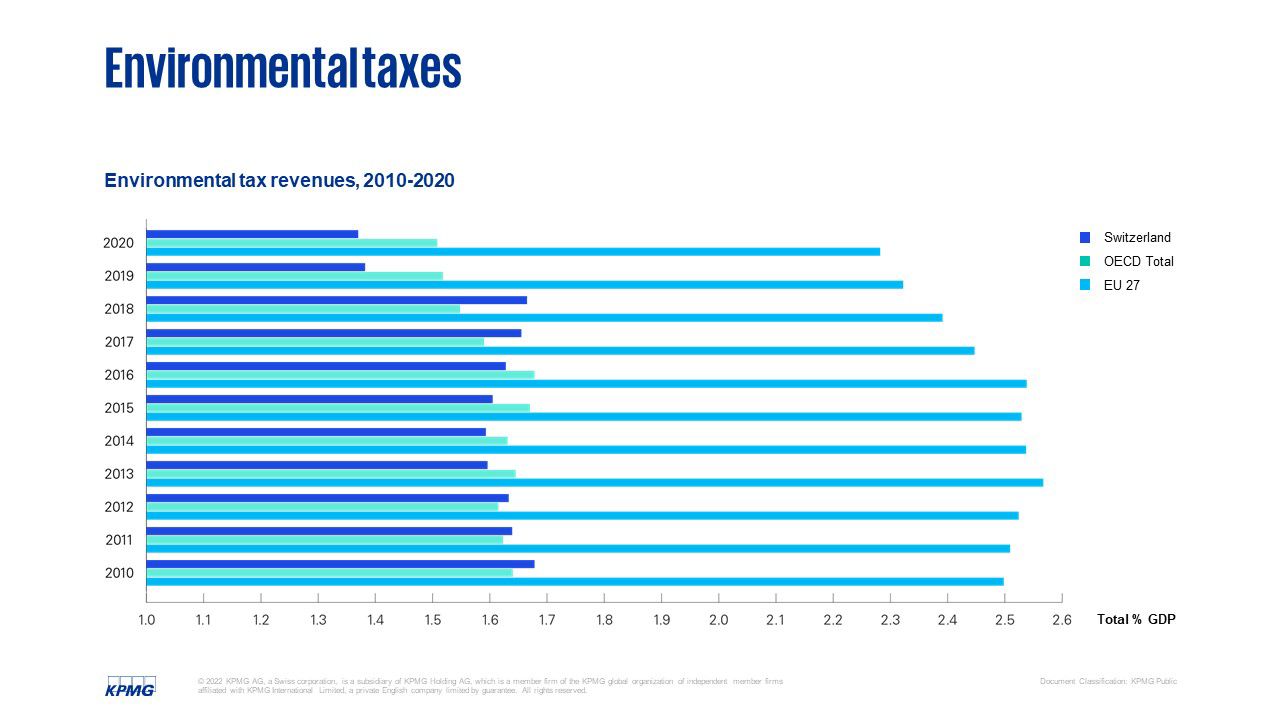

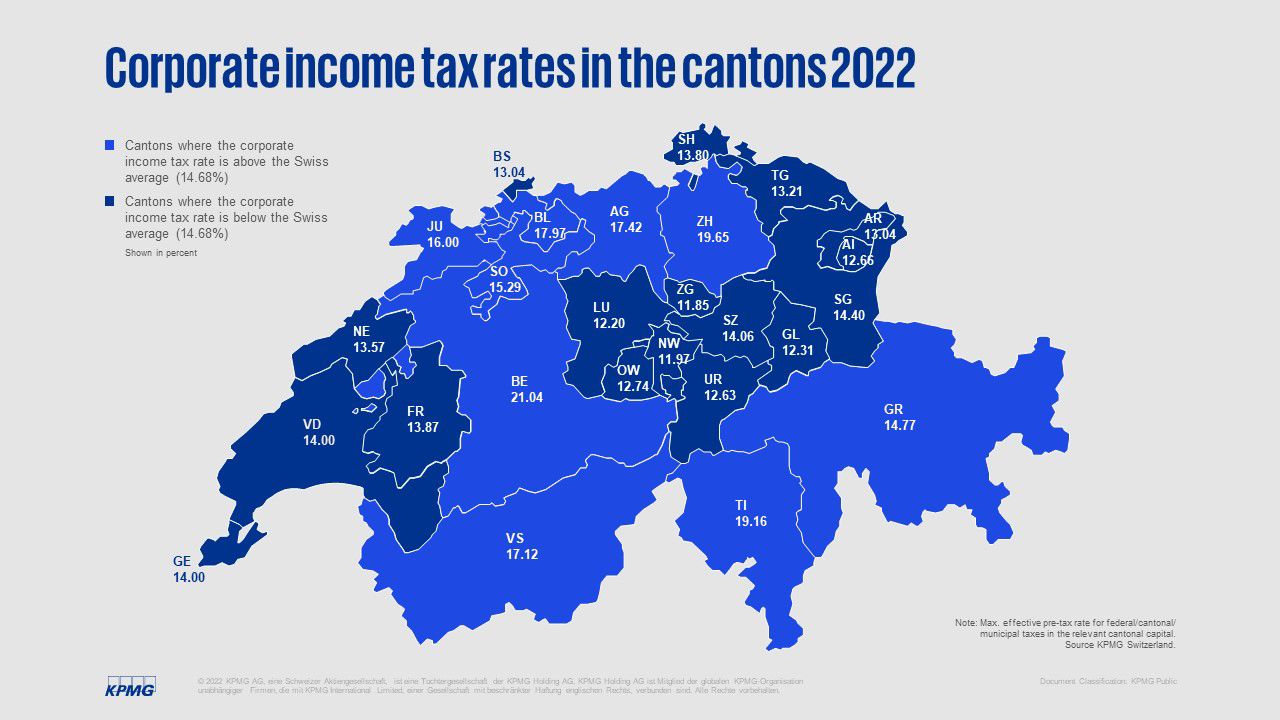

Kpmg Swiss Tax Report 2022 Kpmg Switzerland

Taxes In Switzerland Income Tax For Foreigners Academics Com

Changes To Scottish Income Tax For 2022 To 2023 Factsheet Gov Scot

Kpmg Swiss Tax Report 2022 Kpmg Switzerland

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

New Mexico Tax Rates Rankings Nm State Taxes Tax Foundation

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Tax Year 2022 2023 Resources Payadvice Uk

Income Tax Rates In The Uk Taxscouts

The Complete Guide To The Uk Tax System Expatica

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

How Do Us Corporate Income Tax Rates And Revenues Compare With Other Countries Tax Policy Center

Income Tax Rates In The Uk Taxscouts